7 Questions to Ask Before You Start a Company (or anything new)

Avthar’s Weekly Newsletter #16 (8/16/2020)

Welcome to edition #16 of Avthar’s Weekly Email!

I’m your host, Avthar and this is where I share practical wisdom about startups, learning, health and happiness, all to help you level up your own life.

If you’ve enjoyed my weekly emails, please do share it with friends, family or coworkers!

What’s in this week’s newsletter?

As a former startup founder, I often get asked the question, “What advice would you give to someone wanting to start a company?”.

While working on crystalizing my own advice on the topic, I came across this extremely impactful essay by investor Graham Duncan, titled “Letter to a friend who may start a new investment platform”. Duncan highlights many under-explored factors that everyone should reflect on before starting a company.

In fact, I wish I had read Duncan’s advice prior to starting my first company, Afari, as it might’ve saved me from learning similar lessons through the pain of trial and error.

Duncan’s letter was originally intended for someone founding an investment firm, but the principles he highlights apply to all fields.

So, in this edition of my newsletter, I want to share my commentary on Duncan’s essay, so that his advice can be more easily digested by folks looking to start anything new, no matter the industry or company type.

Here’s what’s in store:

As always, let me know which parts spoke to you by replying to this email or hitting the comment button:

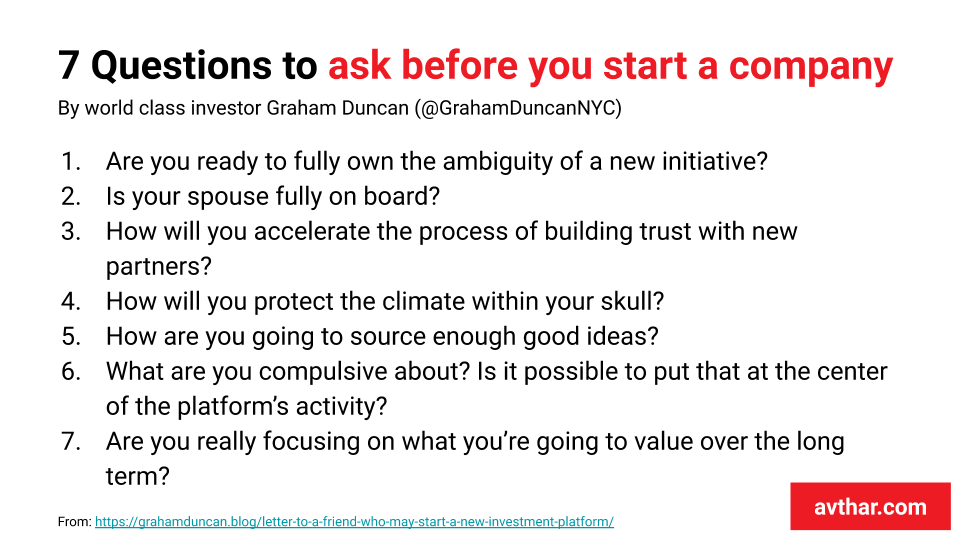

1. Duncan’s 7 Questions to Ask Before Starting a Company (or anything new)

This gem around which Duncan’s essay is arranged are these 7 questions to ask yourself as you think about starting something new:

1) Are you ready to fully own the ambiguity of a new initiative?

2) Is your spouse fully on board?

3) How will you accelerate the process of building trust with new partners?

4) How will you protect the climate within your skull?

5) How are you going to source enough good ideas?

6) What are you compulsive about? Is it possible to put that at the center of the platform’s activity?

7) Are you really focusing on what you’re going to value over the long term?

While all of these questions are worth reflecting on, I want to highlight themes from select questions below as they hit at the most interesting and unusual advice contained in the essay

The themes I’ve cover are:

💪 Playing to your strengths

🌱 Protecting your internal terrain

🤝 Aligning your significant other

⏰ Your long term vision for a happy life

2.💪 Playing to your strengths

Related to: (6) What are you compulsive about? Is it possible to put that at the center of the platform’s activity?

Self Expression and Zone of Genius

Duncan believes that a new venture has the best shot of succeeding when the founders’ main activities are an expression of themselves and use their natural strengths.

He calls this “the zone of genius”:

“I like Josh Waitzkin’s framing of both work and life more generally as an opportunity for self-expression. Ideally this new venture presents an opportunity for you to dial up that self-expression while dialing down activities outside your zone of genius.”

📚Further reading: Long time readers of my newsletter will recognize Josh Waitzkin as the person who’s most influenced my thinking on learning and high performance. You can learn more about his philosophy and mental models here: The Ultimate Guide to Josh Waitzkin

Duncan advises founders to construct their role and their company’s main comparative advantage around their strengths and the things that they are naturally compulsive about:

“Many high achievers are compulsively exploring the world in search of something — some for truth, some for power, others for beauty —

and I think it’s a disservice to yourself and your future partners to not orient your platform around the piece of investing that you really love. Embrace your funk.”

As a first time founder, I often got caught up in doing things I had read or heard that founders should do, rather than focus my role on the things I most enjoyed and activities to which I was most naturally suited. Duncan advises that there’s no mould of a successful founder, you should construct your role around the things you’re compulsive about and outsource the things you’re not good at but you feel you should do:

“Some investors are compulsive about trading, but feel it necessary to play the role of macro thinker or portfolio manager or manager of people, when they really just want to sit in front of the screen and try to make money.

Ultimately, being true to yourself and playing to your strengths gives your company the biggest shot at success.

I've written extensively about the importance of finding your strengths and natural leverage in life. With self-awareness, we can identify our zone of genius and outcompete by focusing on activities within that high-leverage zone.

Find the thing you’d do for its own sake

Duncan believes that playing to your strengths and having a proactive vision of the change you want to make in the world will help you outperform the competition, who are in it for the money or for reasons other than self-expression.

He notes how doing something for its own sake will increase your chances of success in the long run, similar to how tennis phenom Novack Djokovic credits his ability to play at the highest level to the fact that he “like[s] hitting the tennis ball”:

“If you can find the thing you do for its own sake, the compulsive piece of your process, and dial that up and up, beyond the imaginary ceiling for that activity you may be creating, my experience is the world comes to you for that thing and you massively outperform the others who don’t actually like hitting that particular ball.”

Examining your motives and seeing whether you’re starting your new venture from a place of reaction or from a place of expression is a key step Duncan recommends:

“In life and business, “approach” goals are much more effective than “avoidance” goals. It’s important to give yourself enough time to build a positive vision of a future fund [or business] instead of simply reacting against someone else’s vision or your own prior frustrations.”

📚Further reading: If you or someone you know is interested in finding your “zone of genius”, I detail how Reflection and finding your Reflected Best Self can help you do just that.

3.🌱 Protecting your internal terrain

Related to (4) How will you protect the climate within your skull?

Duncan believes that cultivating and preserving a calm internal terrain will help you make the best decisions in order to give your company a shot at long term success.

He goes so far to say that hard work alone will not lead your company to success:

“There is no “product” in your future company beyond your ability to make decisions”

Naval Ravikant has a great line: “if you’re leveraged with capital, code, or people, and own equity, then good decisions have a much larger earning impact than hard work.”

On Hiring

Hiring people that truly believe in you and that will help you trust yourself and your intuition is key to protecting your internal terrain.

You don’t want ‘yes men’, but you also don’t want people who make you second guess your instincts:

“Your primary objective should thus be to maintain the right filters for people and ideas so that the delicate ecosystem in your head is as resilient and flexible as possible.”

“That makes good hiring crucial: the people around you will either protect or infringe on the climate within your skull.”

“Your priority is to protect the climate within your skull and prevent feeling like an imposter in your own firm.”

The Importance of Self Talk

In my essay on Founder Mentality, I argue that founders need to take responsibility for everything that happens in the company, even if it's not their fault.

Duncan advocates for extending this mindset of extreme ownership to your internal terrain, as he believes it's the key characteristic that makes someone a winner:

“ I have puzzled about what makes someone a “winner” for years…

I now see that owning every element of what happens to you, whether or not you can control it, is what leads certain people to be consistently described as “winners” by their former bosses and team.”

“You can extend this approach to owning your climate in the skull. In some ways that’s your primary responsibility as the founder.”

Self-talk, or the way you speak to yourself is a tool Duncan recommends for developing a mindset of ownership.

📚Further reading: Duncan recommends Jocko Willink’s “Field Manual” for an example of a masterclass in self talk.

Watch your Ego Closely

I love how Duncan goes deep into the mental side of being a founder. He warns us of the ego attachment that comes with being a business owner (he uses the word principal), and advises to watch our egos closely, as it clouds your judgement:

“Much of the time, playing the role of principal [read: owner] actually comes with ego attachment that makes it harder to see reality...the more ego attachment you have, the more likely you are to fall prey to cognitive biases such as confirmation bias because it tickles your ego:

Either you made the money, in which case you have lots of identity around the “right” way to invest because it confirms you were smart rather than lucky. Or you inherited the money in which case you (often correctly) think people are friends with you only because of your money.”

Duncan advises us to keep a “quiet ego”, a blank state of mind where we don’t feel the need to make predictions based on false confidence that comes from constructing an identity we feel the need to live up to:

“Consider “I am an expert at energy stocks and experts at energy stocks should always have an opinion on where the commodity price is going”

versus a quieter ego version: “I have no clue where the commodity price is going right now, and that’s okay”.

Enjoy your relatively blank slate, and see if you can keep it blank in the right places.”

The Weird Feeling of taking on other people’s money

In contrast to the wealth of knowledge available on raising money and securing capital for your company, there’s very little to prepare a founder for the feeling of being responsible for other people’s money.

Taking money from other people is associated with caution and shame and guilt if we lose it, so we tend to be extremely risk averse with others money in other areas of our lives. This risk aversion isn’t always optimal for business, as Duncan acknowledges:

“Another thing that’s hard to own somatically (as opposed to cognitively) in advance is what it feels like to lose money for other people.

…a single passive-aggressive joke [from investors or partners] can affect your ability to take risk the way you might with your own capital,

Your job is to protect your psychology in advance, so prepare yourself for innocent clumsiness by your limited partners [or investors].”

4.🤝 Aligning Your Significant Other

Related to (2) Is your spouse fully on board?

Starting a company will test you emotionally, mentally and test the strength of your relationships.

Ensuring that you have full support of your significant other is important before taking the leap to start a venture, otherwise it can create tension which might cause both your company and relationship to fail:

“A start-up requires so much time that if your spouse is resentful or not fully on board, it affects the likelihood of a venture’s success.”

What steps can you take to ensure that your significant other is aligned?

First, Duncan recommends jointly planning this era of your life with your partner, on both business and persona fronts:

“I think it’s best to treat your spouse as a partner and plan out this era of your lives together, setting markers where you’re going to check in on the tempo and possibly adjust it.

More interestingly, Duncan advocates to seriously treat your spouse as a partner and even giving them a percentage of your stake in the company, so that they feel invested in the new venture:

I’d consider giving your spouse some appropriate percentage of your stake in the new enterprise, to make explicit how you value the support and that the venture is something you’re doing together. That way they can help you hold the ambiguity when you’re thinking about work on Saturday morning.”

5.⏰ Your long term vision for a happy life

Related to (7) Are you really focusing on what you’re going to value over the long term?

Is being a founder optimal for you right now?

While being a founder is in vogue these days, it is not the optimal position for all people. Sometimes being a founder can actually detract from you achieving your vision of a fulfilled life.

Duncan advises to challenge your beliefs around the glamour of being a founder and even the fantasy life you’d live if your venture was successful:

“What if being a young agent [employee] who is long on time and short on cash who loves hitting your version of the ball was actually the optimal position for you?”

He also encourages would-be founders to question the belief that all their problems will be solved if their company achieves success.

Think deeply about what the world and your life would look like if your venture was successful and ask yourself, “Do I truly want that future?”:

“What if there was no promised land of security and control on the other side of making a billion dollars?

How would your climate in the skull change if that were your default belief?

Does it extend your time horizon, injecting spaciousness around a given decision?“

📚Further reading: I’ve detailed 9 questions to help you examine your motives, which can help you construct your vision of a fulfilling life.

Time billionaires: Is being a founder the best use of your time?

Duncan ends his letter with a reminder that time, not money, is the most valuable asset in our lives.

Time is non-renewable. You can make more money, but you can’t make more time.

He introduces the wonderful concept of being a “time billionaire”.

If you’re under the age of 40, you’re probably a time billionaire, with more than a billion seconds left in your life.

Founders should think long and hard about whether or not investing the next 5-10 years of their life into their company is the best use of their time, especially if they already have other things they value highly, like a job that is in their zone of genius or family and children:

“A billion seconds is roughly 31 years. I think Rupert Murdoch or some other aging billionaire might enviously see you as a time billionaire — I imagine he’d pay multiple dollar billions for the next five years of your life if he could magically add your sand to his own hourglass.

What price would you sell the next five years to Murdoch for? Stop and actually come up with a true number.

I found my own number in answer to that question has gone parabolic — now approaching infinity — as I have young kids and I found what ball I like to hit and started to play only that game. In retrospect I wish it had gone parabolic even earlier.”

Duncan reminds us that money is a tool to fuel the journey of our lives and create the change we want in the world. Amassing money is but a means to the end of living a good life.

He emphasizes that any venture you think about starting should be an “artistic adventure”, where the venture is an expression of yourself, rather than a means to get money in the hopes of solving your life's problems:

“Tim O’Reilly has a wonderful metaphor for money:

He says money is like gasoline while driving across country on a road trip.

You never want to run out, but the point of life is not to go on a tour of gas stations.

My hope for you is that your new venture will take you far away from the sprawl of the smelly, transactional gas stations, and will instead be an artistic adventure, full of unexpected highs and lows, with just enough gas in your car — or better, fighter jet — to let you stay nimble and still go far.”

➡️ If you enjoyed my commentary on the letter, you can read Duncan’s full version here

🎉 If you enjoyed this newsletter, please do subscribe and share it with ambitious, entrepreneurial friends, family and coworkers: