Hi everyone,

Happy New Year – First, happy new year to you! I hope that 2022 brings you peace, happiness and success!

New name (and schedule) – Second, this email newsletter has a new name: The Lifelong Learner. My motive for writing online is to publicly document my journey of lifelong learning and help others by sharing my life lessons and the best of what I’ve learned about topics I’m curious about. I think this name more accurately reflects that mission (and “weekly wisdom” did sound a bit pretentious). Moreover, in an effort to write deeper, more insightful content, I’m also moving away from the promise to publish weekly and will instead publish this newsletter twice a month going forward.

Extreme Weekly Challenges – Inspired by the annual review question, “What’s the most extreme, crazy or absurd thing you could do in 2022?”, some friends and I have decided to commit to extreme weekly challenges for the month of January. Our goal is to inject some novelty in our routines, challenge ourselves in meaningful ways and most importantly, have fun with friends. Our first challenge is: Write down 100 things you’re grateful for everyday. I invite you to take this challenge with us! And share your thoughts with me on Twitter or by hitting reply.

Onto the topic of today’s letter: money and investing…

Investing and Money: Essential Reads

For many, money is a taboo topic. The money advice most of us received growing up is “don’t spend money”, but very little is said about how to acquire and grow your money, and even less about how to use money as a tool to live a life that’s meaningful and fulfilling to you.

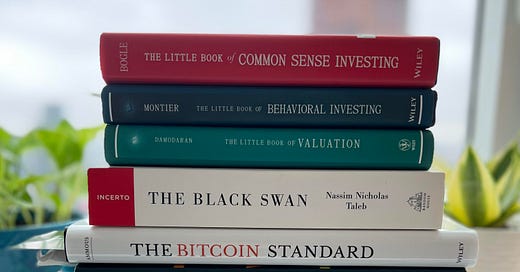

Today I’ll share my top book recommendations on money, finance and investing. I’ve found these books to be a rock-solid foundation in my quest to build generational wealth and achieve financial freedom.

The principles and tactics contained in them will help you whether you’re a student coming to grips with managing your money, a recent grad in your first job ready to make your first investment, or an experienced investor looking to deepen your knowledge and mastery about money and investing.

Four Absolute Must-Reads on Money for Everyone

1. I Will Teach You To Be Rich by Ramit Sethi

If you’re only going to read one book on money in your life, read this. “I Will Teach You To Be Rich” is the single most practical book on money I’ve ever read. It’s helped me with everything from credit cards and automating saving and investing, to negotiating a higher salary and lower rent. What I love most about Ramit is his holistic approach to money, an approach that goes beyond budgets and spreadsheets and looks at psychology, relationships and ultimately how to use money to live a life that’s meaningful to you.

2. The Little Book of Common Sense Investing by John C. Bogle

If you only read one book on investing in your life, read this. I was gifted this book by my uncle upon starting my first job and it taught me about passive vs active investing, compounding, hidden costs and investing for the long term. Here’s the core idea of the book: If you want to make money in the stock market for the long term, invest in low-cost index funds (e.g the S&P 500). It’s a strategy I personally follow as the backbone of my investing approach.

3. What I Learned Losing a Million Dollars by Jim Paul

Every investor will, at some point, lose money. This book identifies the mental processes, behavioral characteristics, and emotions that lead us into those losses, by looking at the real-life story of Jim Paul, who lost $1 Million in a single trade betting on soybeans. It’s a short book that’s as insightful as it is entertaining: it’s taught me about the danger of personalizing success and failure, the mental processes behind investing vs gambling, and the dangers of emotionalism and the crowd. Jim Paul’s story helped me see where I bought or sold irrationally in the past and gave me a foundation for avoiding ruin in the market.

4. The Psychology of Money by Morgan Housel

Most people think financial success is about mastering numbers and money, but in reality it’s about mastering your psychology. This is the most accessible book I’ve found on the mental side of money, why people make bad money decisions and how you can make better ones. Morgan Housel is a wonderful writer and explainer of complex topics. While applicable in its own right, this book is a great primer for some of the more advanced decision making and psychology books in “advanced” section below.

Ten more advanced reads for in-depth financial wisdom

5. Poor Charlie’s Almanack: The Wit and Wisdom of Charles T Munger

A treasure trove of wisdom about mental models, multidisciplinary thinking and investing as a way of life by one of the greatest investors of all time, Charlie Munger.

6. Joy of Compounding by Gautam Baid

A guide to investing as a way of life, incorporating wisdom from Gautam Baid’s own life and the lives of investors like Buffett and Munger.

7. The Black Swan by Nassim Nicholas Taleb

Taught me the importance of tail probabilities and low-probability, but high impact scenarios. These are the sort of things you need to plan for if you’re to be financially successful in the long run.

8. Skin in the Game by Nassim Nicholas Taleb

Taught me to be wary of those who give advice without exposure to the downside of their actions (and hundreds of other lessons for operating in the modern world).

9. The Little Book of Valuation by Aswath Damodaran

Aswath Damodaran is one of the best teachers I’ve ever encountered (not just of financial concepts but teachers of anything) and valuation is his area of expertise. He’s a joy to read (and listen to too!).

10. Think Twice by Michael Mauboussin

Taught me why people make bad decisions, how to make better decisions and why you should keep a prediction journal. It helped me become more disciplined and keep myself intellectually honest.

11. The Narrow Road by Felix Dennis

A no-BS and refreshingly candid perspective on what it takes to build wealth (and keep it) from one of the UK’s most successful entrepreneurs.

12. Enough: Measures of Money, Business and Life by John C. Bogle

An essential book to help you escape the treadmill of comparison, envy and scarcity that everyone encounters on their journey to building wealth. The story behind the title of the book immediately hooked me: “At a party given by a billionaire on Shelter Island, the late Kurt Vonnegut informs his pal, the author Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch 22 over its whole history. Heller responds, “Yes, but I have something he will never have . . . Enough.”

13. How to Get Rich (Without Getting Lucky) by Naval Ravikant

The only non-book on this list, but it’s brilliance justifies its inclusion. It’s the ultimate guide to building wealth in the internet age from someone who’s actually done it.

14. The Bitcoin Standard by Saifedean Ammous

I’m optimistic about Bitcoin, cryptocurrencies and blockchain technology in general. I found this book a great introduction to the importance of Bitcoin in the global financial system.

🗣️ Are there any books on money, finance and investing that have greatly impacted your life? I’d love to hear about them! Let me know in the comments or by replying to this email.

🙏 Thank you again for reading and for your support! I hope that these books will help make 2022 a prosperous year for you!

With gratitude,

Avthar